Polystyrene Market Volume to Reach 62.33 Million Tons by 2034 | Says Towards Chem and Materials

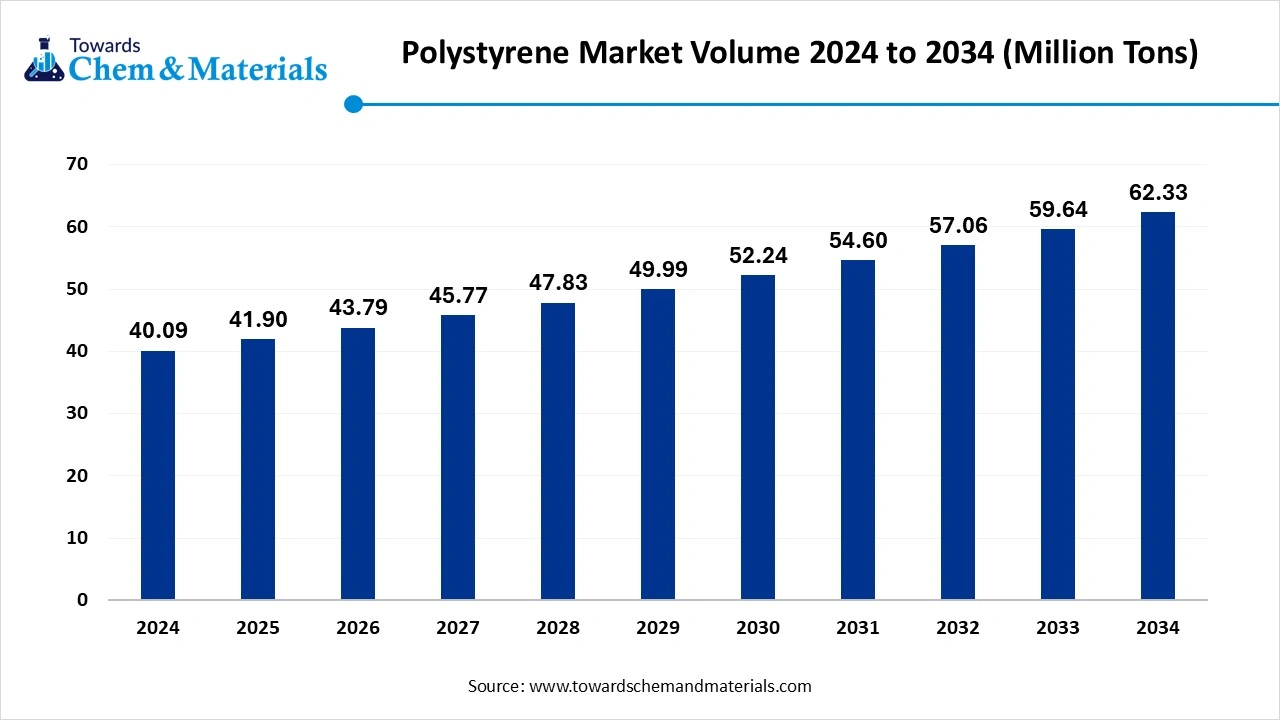

According to Towards Chem and Materials, the global polystyrene market volume is calculated at 41.09 million tons in 2025 and is expected to reach around 62.33 million tons by 2034, growing at a CAGR of 4.51% for the forecasted period.

Ottawa, July 02, 2025 (GLOBE NEWSWIRE) -- The global polystyrene market volume was valued at 40.09 million tons in 2024 and is projected to hit around 62.33 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.51% over the forecast period 2025 to 2034. Asia Pacific dominated the Polystyrene market with a market volume share of 48.50% in 2024. a study published by Towards chem and Materials a sister firm of Precedence Research.

The market is steadily growing driven by strong demand from its various end-use sectors, including packaging, electronics, and building and construction. Demand drivers include cost efficiency, insulating properties, and the continued shift toward recycled and lighter weight materials across numerous industries.

Polystyrene is an artificial aromatic polymer produced by the polymerization of monomer styrene, which is popular due to its lightweight, flexibility, insulation, and mouldable nature. Polystyrene comes in two forms, solid (used in appliances, and electronics, and packaging) and foam (for insulation and disposable cups). The polystyrene market will depend mainly on demand in a few markets including packaging, consumer electronics, and construction. With the rise of e-commerce and cold-chain logistics, polystyrene has continued to be significant in the market for protective packaging. However, as environmental concerns grow and governments ban single-use plastics, producers have been exploring biodegradable alternatives or making efforts to recycle polystyrene.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5589

Polystyrene Market Report Highlights

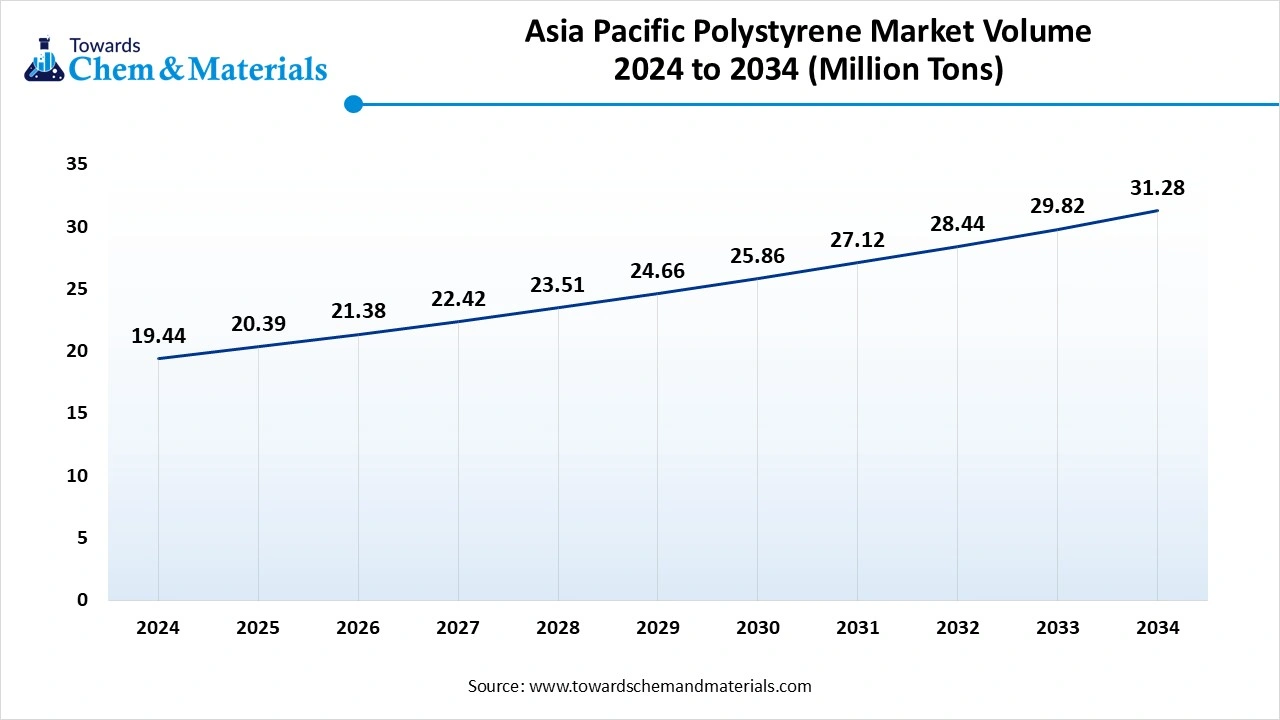

- The Asia pacific polystyrene industry volume is estimated at 20.39 million tons in 2025, and is expected to reach 31.28 million tons by 2034, at a CAGR of 4.87% during the forecast period 2025-2034

- Asia Pacific is the dominating region of the global polystyrene industry and accounted for more than 48.50% Volume share of the overall Volume in 2024.

- By Resin Type, the general-purpose polystyrene segment accounted for the largest market Volume share of 35.67% in 2024

- By Form, the Foams is the dominating form type segment of the global polystyrene market and accounted for more than 59.50% Volume share of the overall Volume in 2024

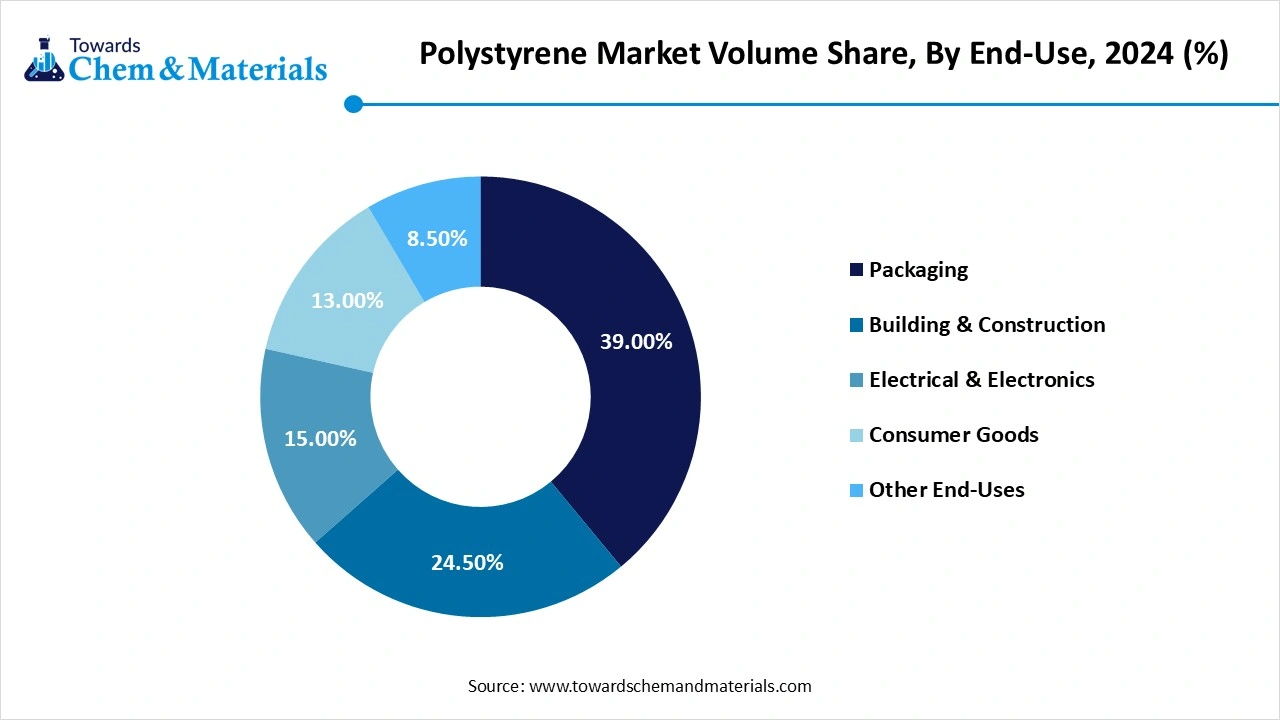

- By End-use , the Packaging is the dominating end-use segment of the global polystyrene market and accounted for more than 39% Volume share of the overall Volume in 2024

Polystyrene Market Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 41.90 Million Tons |

| Expected Volume by 2034 | 62.33 Million Tons |

| Growth rate | CAGR of 4.51% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2019 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2034 |

| Report coverage | Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Resin Type , By Form ,By End-User, Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; MEA |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands, China, India, Japan, South Korea, Australia, Thailand, Malaysia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, UAE , South Africa |

| Key companies profiled | Atlas Molded Products, Alpek S.A.B. de CV, Americas Styrenics LLC (AmSty), BASF SE, CHIMEI, Formosa Chemicals & Fibre Corp., INEOS Styrolution Group GmbH, Innova, KUMHO PETROCHEMICAL, LG Chem, SABIC, Synthos, Total, Trinseo, Versalis SpA |

Explore Strategic Figures & Forecasts – Access the Databook | Immediate Delivery Available: https://www.towardschemandmaterials.com/download-databook/5589

Polystyrene Market Uses & Benefits

- Polystyrene in Appliances: Refrigerators, air conditioners, ovens, microwaves, vacuum cleaners, blenders – these and other appliances often are made with polystyrene (solid and foam) because it is inert (doesn’t react with other materials), cost-effective and long-lasting.

- Polystyrene in Automotive: Polystyrene (solid and foam) is used to make many car parts, including knobs, instrument panels, trim, energy absorbing door panels and sound dampening foam. Foam polystyrene also is widely used in child protective seats.

- Polystyrene in Electronics: Polystyrene is used for the housing and other parts for televisions, computers and all types of IT equipment, where the combination of form, function and aesthetics are essential.

- Polystyrene in Foodservice: Polystyrene foodservice packaging typically insulates better, keeps food fresher longer and costs less than alternatives.

- Polystyrene in Insulation: Lightweight polystyrene foam provides excellent thermal insulation in numerous applications, such as building walls and roofing, refrigerators and freezers, and industrial cold storage facilities. Polystyrene insulation is inert, durable and resistant to water damage.

- Polystyrene in Medical: Due to its clarity and ease of sterilization, polystyrene is used for a wide range of medical applications, including tissue culture trays, test tubes, petri dishes, diagnostic components, housings for test kits and medical devices.

-

Polystyrene in Packaging: Polystyrene (solid and foam) is widely used to protect consumer products. CD and DVD cases, foam packaging peanuts for shipping, food packaging, meat/poultry trays and egg cartons typically are made with polystyrene to protect against damage or spoilage.

What are the Major Trends in the Polystyrene Market?

- Strong demand in food packaging- The insulation qualities of polystyrene make it optimal for disposable containers. The increase of takeaway food packaging delivery to consumers, particularly in urban areas, will increase overall demand.

- Growth of construction activities- EPS (Expanded Polystyrene) is commonly used as a storage medium in walls and roofs. The expanding green building initiatives in Europe and Asia are driving substantial market growth.

-

Increase in electrical & electronics manufacturing- High Impact Polystyrene (HIPS) is an excellent choice for electronic housing. The rise of some of the world's largest phones and appliances manufactured in China and Southeast Asia is accelerating use.

Growth Factors in the Polystyrene Market

Transitioning to Recyclable and Bio-Based Polystyrene

Bio-based and chemically recyclable Polystyrene is the answer to today's sustainability challenges and increasing regulatory pressure on traditional single-use plastics. The manufacturing sector is exploring innovative and game-changing paths forward-related to chemical recycling, and bio-based alternatives are being embraced by consumers -many hoping to explore them further.

Increased Demand for E-Commerce Packaging

The emergence of e-commerce and cold chain logistics has placed much more attention and demand on lightweight and protective packaging, especially involving electronics, food delivery via take-out and frozen meal subscriptions, and pharmaceutical shipping.

Developments In Lightweight Construction

Expanded polystyrene (EPS) is starting to take hold in the construction industry for insulation and structural applications due to its lightweight, energy efficiency advantages, and cost-savings in the green building sector.

How Artificial Intelligence is Innovating the Polystyrene Market in 2025?

Artificial Intelligence is emerging as a major influencer in the polystyrene industry, improving efficiencies in production, recycling and supply chain management. In production, companies are increasingly using AI powered systems to refine process controls in the production of expanded and extruded polystyrene to reduce energy consumption and ultimately material waste. Most recent developments in Europe and North America have focused on implementing AI enabled optical sorting machines to better identify and sort polystyrene waste, greatly advancing recycling rates.

Chemical recycling technologies which AI can help advance are also emerging, compacting expanded polystyrene waste by upwards of 90%, reducing overall transportation cost and environmental impact. As sustainability mandates become stricter and circular economy goals become more established, we can expect AI will be a main catalyst in changing the polystyrene industry in 2025 and beyond.

Could Global EPS Recycling Expansion Unlock Opportunity For Sustainable Polystyrene?

The global polystyrene industry has a worthwhile and potentially huge opportunity, due to expanded polystyrene (EPS) recycling expansion - which has now transitioned from single-country initiatives to an international study. The Global EPS Sustainability Alliance confirmed that by 2023, 72 separate countries now have established EPS recycling systems: with some tracking EPS recycling rates of more than 30%, including China (46%), Japan (68%), Korea (88%) and Taiwan (83%).

The United Nation's Environment Programme (UNEP) has even classified EPS transport‑packaging into one of only six plastics that can be reported as recycled at the scale worldwide.

The spread of EPS recycling systems, although mostly government mandated, represents a strong framework for establishing closed‑loop systems, in response to public demand for a more sustainable circular economy. With development of regulations and infrastructure, polystyrene waste is seeing recognition as a proven high-value feedstock for recycling businesses worldwide - providing a strong indicator for expected environmental and economic potential in the future.

Limitations and Challenges in the Polystyrene Market

- Environmental Impact & Regulations- Polystyrene is non-biodegradable, contributing significantly to plastic pollution. The growing number of government limitations and international environmental regulations has been forcing many industries to switch to more sustainable substitute materials to limit further and future polystyrene use in many applications.

- Risks of Styrene Health Effects- Styrene, the critical raw material in polystyrene, are classified as a possible carcinogen to humans. Long-term exposure is risky, creating health concerns for manufacturers and consumers, and leading to stricter occupational workplace safety requirements.

-

Movement Towards Eco-Friendly Replacements- The increasing prevalence of biodegradable and recyclable materials, including PLA and paper-based materials is lowering the demand for traditional polystyrene, especially in packaging. Consumer preference for green alternatives is changing the markets and limiting polystyrene growth.

Invest in Premium Global Insights Immediate Delivery Available @ https://www.towardschemandmaterials.com/price/5589

Why is Asia Pacific Leading the Polystyrene Market in 2024?

The Asia-Pacific Polystyrene market volume was valued at 19.44 volume million tons in 2024 and is expected to be worth around 31.28 volume million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.87% over the forecast period 2025 to 2034.

Asia Pacific constitutes the largest polystyrene market in 2024, due to its cost-efficient production, established manufacturing base, and expanding construction and packaging industries. Rising population, urbanization, disposable income growth, and values of convenience and comfort have all driven demand for consumer and electronic goods in the Asia Pacific region, subsequently increasing the demand for forms of polystyrene such as foams and sheets. Favourable government policies and a strong supply chain in the petrochemical sector are also contributing to high polystyrene consumption in the region. Moreover, increasing investments into future-proof infrastructure projects are further expanding consumption of polystyrene.

Trends in China

China is a leading contributor because of its extensive supply chains in electronics manufacturing and packaging, as well as the continued growth of disposable packaging and construction industries. E-commerce has also brought in more business, alongside a very high consumption of plastics. The expansion of innovations in recyclable and bio-based alternatives is pushing domestic companies to develop new sustainable products based on polystyrene. China is the center for polystyrene in both volume produced and general product development.

Why North America showing up as the Fastest Growing Region in Polystyrene?

North America is developing as the fastest-growing area in the polystyrene market during the forecast period. This is being supported by an increase in demands in the food packaging, electronics, and healthcare industries. New developments in high-impact and eco-friendly polystyrene products are increasing adoption into sustainable construction and medical uses. In addition to the advancements in polystyrene products, government incentives and increasing momentum towards raising awareness through the promotion of plastic recycling is leading companies and manufacturers to move towards innovation and circular economy practices.

Market Trends in the U.S.

The United States is investing in sustainable packaging, because of the varied manufacturing structures and an expanding food delivery service and consumer electronics sector. These developments continue to boost demand for polystyrene in applications that value lightweight performance alongside maintaining durability and recyclability.

For more information, visit the Towards Chem and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Polystyrene Market Segmentation

Resin Type Insights

What Type of Resin is the Most Dominant in Polystyrene Market?

General Purpose Polystyrene (GPPS) segment dominated the polystyrene market in 2024. GPPS is a great choice for all applications where clarity, rigidity, and ease of processing are needed such as thermoform and extrude packaging, lab ware, and consumer products. GPPS is predictable in how it will thermoform and extrude while offering great value and moldability. GPPS generally has great compatibility with other polymers.

Polystyrene Market Volume & Share, By Resin Type, 2024 - 2034 (%)

| By Resin Type | Volume Share, 2024 (%) | Volume Million Tons 2024 | Volume Share, 2034 (%) | CAGR (2025 - 2034 ) | Volume Million Tons 2034 | |||

| General Purpose Polystyrene (GPPS) | 35.67 | % | 14.30 | 16.20 | 1.25 | % | 25.99 | % |

| High Impact Polystyrene (HIPS) | 28.12 | % | 11.27 | 22.94 | 7.36 | % | 36.80 | % |

| Expandable Polystyrene (EPS) | 36.21 | % | 14.52 | 23.19 | 5.34 | % | 37.21 | % |

| Total | 100.00 | % | 40.09 | 62.33 | 4.51 | % | 100.00 | % |

High Impact Polystyrene (HIPS) segment expects the fastest growth in the market during the forecast period, primarily due to its increased strength and impact resistance. HIPS is a strongly emerging material in areas where strength, aesthetics and durability is required. Compared to GPPS, HIPS processability for metamorphic applications in extrusion and thermoforming is better; the matte finish is also good when you have a printed surface for consumer products. The broadening of overall use areas in electronics housings, refrigerator linings and industrial packaging is part of the story of increased demand for HIPS, given the infrastructure and appliance markets in Asia and Eastern Europe that are growing.

Form Insights

Which Form Dominates the Polystyrene Market in 2024?

Foams segment dominated the polystyrene market in 2024. Their lightweight and advantageous insulation properties make foams innovative materials for thermal insulation, cushioning, and protective packaging. Advancements in foam-based polystyrene—particularly EPS—have led to demand for though not limited to those applications in the construction (as insulation) and packaging (as protective padding) sectors. Foams used for those applications or uses are low-cost, moisture-resistant, and energy efficient; hence, buildings need those materials to be insulated, and cold-chain packaging needs them for protective packaging.

Polystyrene Market Volume Share, By Form, 2024 - 2034 (%)

| By Form | Volume Share, 2024 (%) | Volume Million Tons 2024 | Volume Share, 2034 (%) | CAGR (2025 - 2034 ) | Volume Million Tons 2034 | |||

| Foams | 59.50 | % | 23.85 | 34.90 | 3.88 | % | 56.00 | % |

| Films & Sheets | 14.20 | % | 5.69 | 9.72 | 5.50 | % | 15.60 | % |

| Injection Molding | 21.80 | % | 8.74 | 14.59 | 5.86 | % | 23.40 | % |

| Other Forms | 4.50 | % | 1.80 | 3.12 | 6.26 | % | 5.00 | % |

| Total | 100.00 | % | 40.09 | 62.33 | 4.51 | % | 100.00 | % |

Injection molding segment expects the fastest growth in the market during the forecast period, owing to growing demand for features designed for precision-engineered plastic components. The injection molding process allows for complex part designs and effective large-volume production while minimizing waste and rework. Manufacturers increasingly use polystyrene molded parts in electronics, automotive interiors, and consumer items due to the dimensional stability and lightweight properties. The expansion of automation in manufacturing and increased technological advancement of mold designs will further facilitate growth in the use of plastics via injection molding.

End User Insights

Why Packaging Segment Dominates the Polystyrene Market in 2024?

Packaging segment dominated the market in 2024 since polystyrene is lightweight, insulating, and protective. From food containers and trays to industrial packaging and insulation wraps, it meets a variety of packaging needs across industries. Its capacity to preserve freshness, resist moisture, and reduce transportation costs make polystyrene ideal for perishables. Additionally, polystyrene is recyclable and comes in rigid and foam forms, all supporting its predominant use in retail and industrial packaging applications. Growing e-commerce and global trade continues to drive packaging-related demand.

The consumer goods segment expects the fastest growth in the market during the forecast period, due to the increasing use of polystyrene in disposable cutlery, food containers, packaging foams, and cosmetic product casings. The versatility of culture products as a lightweight material and the flexibility it provides for designers make it the best solution for manufacturers and the end consumer. The growing demand for ready-to-eat food and convenience food packaging is being driven by the increase in the working population, an adapted lifestyle, and other demands on consumers' time. Convenience food consumption is growing rapidly globally and is poised to continue growing.

Polystyrene Market Volume & Share, By End-Use, 2024 - 2034 (%)

| By End-Use | Volume Share, 2024 (%) | Volume Million Tons 2024 | Volume Share, 2034 (%) | CAGR (2025 - 2034 ) | Volume Million Tons 2034 | |||

| Packaging | 39.00 | % | 15.64 | 22.75 | 3.82 | % | 36.50 | % |

| Building & Construction | 24.50 | % | 9.82 | 16.08 | 5.05 | % | 25.80 | % |

| Electrical & Electronics | 15.00 | % | 6.01 | 9.60 | 4.79 | % | 15.40 | % |

| Consumer Goods | 13.00 | % | 5.21 | 8.54 | 5.06 | % | 13.70 | % |

| Other End-Uses | 8.50 | % | 3.41 | 5.36 | 4.63 | % | 8.60 | % |

| Total | 100.00 | % | 40.09 | 62.33 | 4.51 | % | 100.00 | % |

Competitive Landscape in the Polystyrene Market

- INEOS Styrolution- World's largest styrenics producer; offers wide PS portfolio for packaging, appliances, and healthcare.

- TotalEnergies- Major PS producer in Europe; invests in PS recycling technologies, including depolymerization.

- Dow Chemical Company- Formerly a large PS player; now supports value chain with focus on sustainability and material science.

- SABIC- Once a PS producer; now more active in other polymers but contributes to innovation and R&D

- BASF SE- Diversified chemicals player; involved in PS through EPS and joint ventures.

- LG Chem- Offers specialty PS resins; not a leading global PS producer but contributes to high-end applications.

- Chevron Phillips Chemical Company- Focused mainly on polyolefins; minor role in PS through partnerships or specialty chemicals.

- Synthos S.A.- Key European EPS and PS supplier; strong presence in insulation and packaging sectors.

- Versalis S.p.A.- Supplies GPPS and HIPS; involved in PS recycling and circular economy projects.

- Trinseo- Major PS supplier in NA and EU; strong in performance PS and advancing circular solutions.

-

Nova Chemicals Corporation- North American EPS leader; supports sustainable packaging and innovation in PS applications.

What is Going Around the Globe?

- In June 2025, Sulzer Ltd. Introduced latest licensed EcoStyrene polystyrene recycling technology, a revolutionary method for the recycling of polystyrene material contamination.

- In January 2025, Ineos Styrolution, announced its first project involving mechanically recycled polystyrene (rPS)for yogurt cup applications. Dr. Frank Eisenträger, market development manager, at Ineos Styrolution said, “This technology will enable producers to meet the requirements of the new EU directive on packaging and packaging waste (PPWR).”

-

In February 2025, Trinseo began offering Europe’s first transparent dissolution recycled polystyrene (rPS) that is suitable for direct food contact, made from 30% recycled content, which is commercially available. The product is made from polystyrene from pre- and post-consumer products collected by Heathland, Trinseo's recycling partner, and is estimated to deliver an 18% reduction in carbon footprint, compared to virgin polystyrene.

You can place an order or ask any questions, please feel free to contact at sales@towardschemandmaterials.com| +1 804 441 9344

More Insights in Towards Chem and Materials:

- Polyolefin Market : The global polyolefin market volume accounted for 241.98 million tons in 2025 and is forecasted to hit around 371.54 million tons by 2034, representing a CAGR of 4.88% from 2025 to 2034.

- Polymer Modified Bitumen Market: The global polymer modified bitumen market volume was 25.70 million tons in 2024 and is projected to grow from 26.86 million tons in 2025 to 39.90 million tons by 2034, exhibiting a CAGR of 4.50% during the forecast period. Asia Pacific dominated the market with market volume share of 44.31% in 2024.

- Recycled Polyolefin Market : The global recycled polyolefin market size was accounted for USD 61.19 billion in 2024 and is expected to be worth around USD 144.2 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.95% during the forecast period 2025 to 2034.

- Fertilizers Market : The global fertilizers market volume was 193.20 million tons in 2024 and is projected to grow from 199.19 million tons in 2025 to 262.18 million tons by 2034, exhibiting a CAGR of 3.10% during the forecast period.

- Specialty Fertilizers Market : The global specialty fertilizers market volume is calculated at 30.23 million tons in 2024, grew to 31.75 million tons in 2025, and is projected to reach around 49.33 million tons by 2034.The market is expanding at a CAGR of 5.02% between 2025 and 2034.

- Enzymes Market : The global enzymes market volume was 746.40 kilo tons in 2024 and is projected to grow from 791.58 kilo tons in 2025 to 1343.40 kilo tons by 2034, exhibiting a CAGR of 6.05% during the forecast period. In 2024, North America dominated the enzymes market with a volume share of 32.12% in 2024.

-

Agricultural Enzymes Market : The global agricultural enzymes market size was valued at USD 619.13 million in 2024. The market is projected to grow from USD 675.53 million in 2025 to USD 1480.56 million by 2034, exhibiting a CAGR of 9.11% during the forecast period.

Polystyrene Market Top Key Companies:

- INEOS Styrolution

- TotalEnergies

- Dow Chemical Company

- SABIC

- BASF SE

- LG Chem

- Chevron Phillips Chemical Company

- Synthos S.A.

- Versalis S.p.A.

- Formosa Chemicals & Fibre Corp.

- Trinseo

- Nova Chemicals Corporation

- Chi Mei Corporation

- Supreme Petrochem Ltd.

- Americas Styrenics LLC

Polystyrene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chem and Materials has segmented the global Polystyrene Market

By Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2034)

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expandable Polystyrene (EPS)

By Form Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2034)

- Foams

- Films & Sheets

- Injection Molding

- Other Forms

By End-User Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2034)

- Packaging

- Building & Construction

- Electrical & Electronics

- Consumer Goods

- Other End-Uses

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2034)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5589

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chem and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.